Simple Savings Sunday – Creating Savings Buckets

Welcome back to Simple Savings Sunday here at Wealth Bytes. This is a series I started last year and I post only when I come up with helpful tips on saving money. You can check out all of the Simple Savings Sunday articles and hopefully they can give you a simple way to save. Since it’s the weekend of July 4th, I don’t want to do a massive post about a hard to follow tip. Today, I want to provide you with a great savings tip which I used to get out of my credit card debt. The savings tip revolves around bucketing. Specifically, savings buckets. Now, what are savings buckets?

The Savings Bucket

Savings buckets, or bucketing, is a process where you divide out your savings into segments. Those segments are called buckets. This allows you to put your savings to use in specific areas without draining it all in one spot. Basically, if you were to take out all of your savings in the form of cash, then put out a bunch of buckets. You would write what each bucket was for to drill down your savings. For example, one bucket could be for a down payment on a house. Another could be your emergency fund. Another can be for a vacation or trip you want to take. You can have as many buckets as you need. If you were then to take the cash and put money into each bucket, you would essentially be bucketing your savings.

You don’t have to put equal amounts into each bucket, but you should fill each bucket with something. I like to use the percentage approach. So, if I wanted to grow my emergency fund, I might put 50% of my extra money into that bucket. I would then divide up the rest of the 50% and put it into each bucket I have left. You can decide which bucket takes priority. That’s the best part about the savings bucket system. You control everything and can fill one bucket more than another depending on your goals.

So, you might be wondering what a good way to bucket might be. Today, I’m going to show you how to start a savings bucket with Capital One 360. I have their free savings and checking accounts, and they make it super easy to “bucket” your savings. To make it easier, I opened a new account for testing purposes and to show you how to set up the savings buckets. You’ll only see that I have their free checking account in this setup.

Step 1 – Open a Free Capital One 360 Account

Savings buckets can be done in many bank accounts, but they have to allow for free savings accounts to be setup. Capital One 360 allows for 25 savings accounts to be setup under each account. That’s a lot! I know one of my banks allows me to have free “virtual” savings accounts to be set up, but they have fees on their normal checking account, so I don’t use this feature much. If your bank doesn’t allow for this, then open a free Capital One 360 account and be on your way.

Step 2 – Create Savings Account

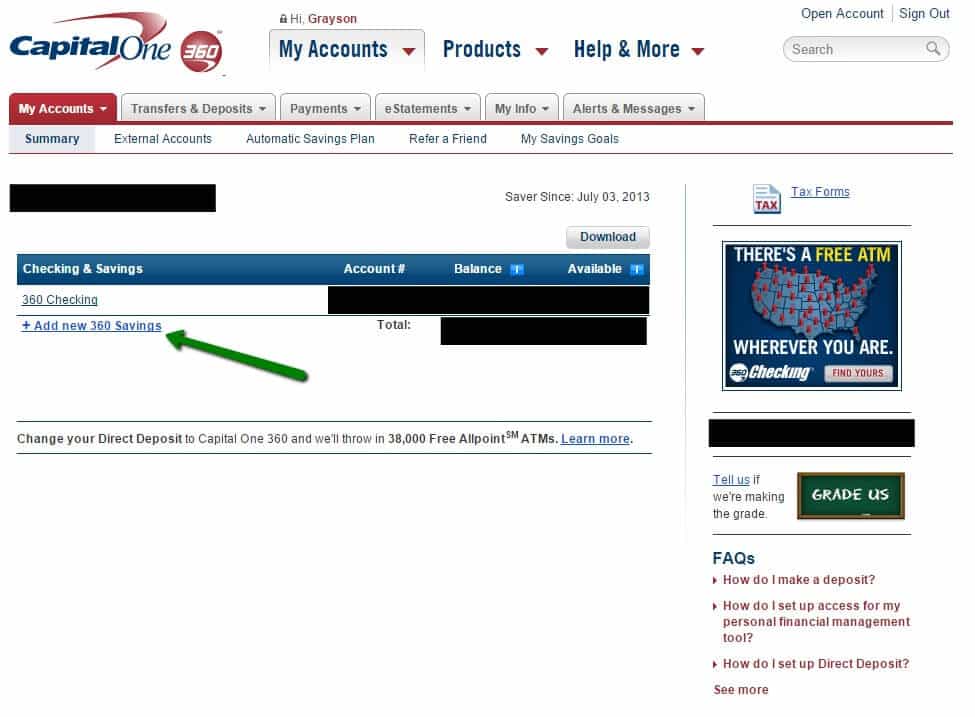

This is where the fun comes into play. I put a screenshot on where to do this if you already have a checking account with Capital One 360. You can do it on your home dashboard screen.

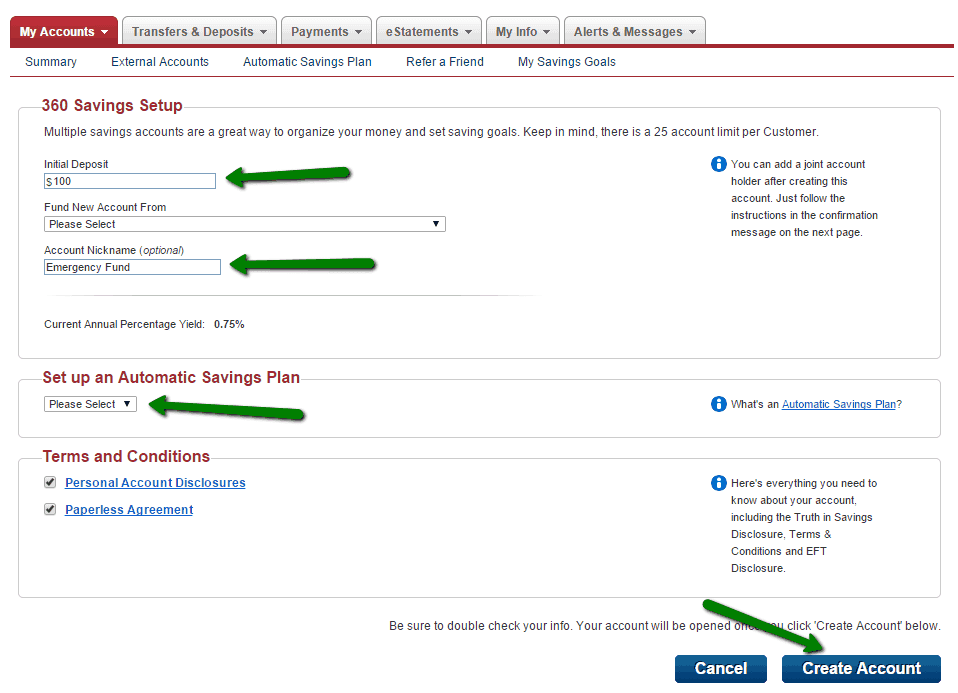

Once you click that link, it will bring you to a page where you create and fund each savings account. The trick here is to do it in a way where you label the savings accounts based on your goals. So, one can be called “Emergency Fund” and another can be called “Vacation.” You can create as many as you like (up to the 25 account limit) and that will be your buckets. Now, Capital One does allow you to do Automatic Savings, which is a program that gives you the power to put money into those savings accounts on a regular and automatic basis. I think automated savings is the best way to do it. If you want to do automatic savings, then select that on this page. If not, then select no.

You can set up each one differently, so if you want your emergency fund to be grown automatically, then allow Capital One to do that for you. It’s your choice and you have full control.

Step 3 – Rinse and Repeat (Creating Multiple Bucketes)

You just go through this process as many times as you need to create your savings buckets. It’s really that easy. Now, once you have them created, you can fund them as easily as transferring from your regular bank account or from your Capital One 360 checking account (if you signed up for one). This really is the easiest and best ways to save money and doesn’t take much to do. The best part is it gives you the ultimate view on how your savings is doing. If you have savings goals, separating your money into buckets gives you the control you need to tweak your plans. I have multiple buckets in two bank accounts I use, including Capital One 360.

There you have it my savings friends! Not much harder than that. Check your current bank to see if you have free savings accounts and how many you can have. If there is a strict limit or they make it hard to sign up for them, then move on. There are better options out there and Capital One 360 is one I use and recommend. Also check out a nearby credit union if you can. Mine gives me three click savings account creation with no limit on how many I want or need to have. It’s nice!

Well, enjoy the rest of your day and weekend. I hope you will think about adding the savings buckets to your financial arsenal. There is not much better than a great savings plan!

I’ve been using the Capital One 360 buckets for awhile now and it definitely helps with organizing your money and keeping things straight. I would recommend them to anyone looking to separate out their savings while getting some sort of interest.

Good idea for a series! I never thought of them as savings buckets before, though I do have a literal savings “jar” where I sometimes throw loose change I happen upon, etc. I love CapitalOne360 too. That’s always a good savings recommendation!

Thanks Kayla! I also have a saving jar where I put change. I keep it for my son and let him put the change in the jar. He likes it, but enjoys taking it out even more!