TransUnion Credit Lock Review – Take Control of Your Credit Report

I was lucky enough to be able to try out a new service from TransUnion. I will disclose I was provided the service to try and review. This review is based on me testing the service and my opinions are my own. If you aren’t familiar with TransUnion, then let me give you a quick brief. TransUnion is one of the three national credit rating bureaus in the US. You know, the ones that control your credit report! The three are TransUnion, Equifax, and Experian. TransUnion was started back in 1968 as the parent company to a railcar leasing operation. They acquired a company in 1969, which maintained 3.6 million card files. Over the years, they have changed the way we look at credit and how we view it as customers. Before I dig into the new service itself, let’s talk about the importance of keeping up with your credit score and report.

I was lucky enough to be able to try out a new service from TransUnion. I will disclose I was provided the service to try and review. This review is based on me testing the service and my opinions are my own. If you aren’t familiar with TransUnion, then let me give you a quick brief. TransUnion is one of the three national credit rating bureaus in the US. You know, the ones that control your credit report! The three are TransUnion, Equifax, and Experian. TransUnion was started back in 1968 as the parent company to a railcar leasing operation. They acquired a company in 1969, which maintained 3.6 million card files. Over the years, they have changed the way we look at credit and how we view it as customers. Before I dig into the new service itself, let’s talk about the importance of keeping up with your credit score and report.

Your Credit Speaks A Lot About You

Your credit profile doesn’t leave much to the financial imagination. With a couple of inquiries, banks can know about most of your buying and payment habits. They know where you live, what car you drive (if you bought with a loan or lease), your home price, what credit cards you have, and much more. It’s a deep look into your borrowing lifestyle. Since Americans love to borrow, credit reports and scores have become very valuable.

Many believe that keeping a high credit score and clean report is not necessary unless you are looking to get a loan. Well, that’s not necessarily true. Many car insurance agencies run your credit. They approve you and give you rates partly based on your credit. A potential employer can look to see if you have credit issues. Those issues could cost you a job. You might not be able to rent a place to live based on your credit, or purchase a cell phone plan. Your credit is used in more ways than most think. It’s imperative to keep a high credit score and a clean report.

If you want to base your good credit on borrowing alone, you never know when you might need to borrow. If your car dies and you need a loan to get another one, good credit will keep your rates low. While it’s always a nice dream to have enough in cash to buy another car, most people are not in that situation. Having good credit offers you opportunities to do things with money other people can’t.

OK, let’s get back to the new service, which TransUnion calls Credit Lock. The name is self-explanatory. This service is part of their credit monitoring service. For $17.95 per month, you can unlimited access to your credit report and VantageScore. It is one of your credit scores, but it’s not your FICO score. The VantageScore is TransUnion’s own credit scoring model. This new Credit Lock service was added as a benefit to their members.

What is Credit Lock?

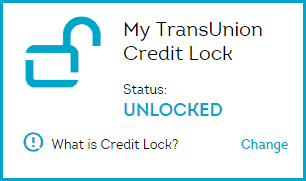

As the name implies, this new TransUnion service gives you the ability to lock and unlock your TransUnion credit report. Now, why is this important? Well, with the increase in identity theft and people borrowing money in other people’s name, locking your credit report is really important. When you lock your credit report, banks and other institutions that want to look at your credit can’t. No new inquiries are possible when your credit is locked. It gives you the ultimate control of your credit report. Remember, it is your report, so why not control it?

Once you have TransUnion’s credit monitoring service, you have access to their credit lock feature. Now, with just a click of your mouse, you can lock and unlock your TransUnion credit report. It’s recommended by them and many others that you keep your credit reports locked until you need it. Before Credit Lock, you had to call TransUnion and wait on the phone in order to lock your report. Now, it only takes a few seconds. The other two bureaus still require you to make the phone call, but you really should lock access to all three. It’s one of the easiest things to do to protect your financial profile.

Credit Lock is available on your computer, tablet, and smartphone. If you have the TransUnion app on your phone, you can log in, enter you pin, and simply swipe to lock and unlock your credit report. It’s that easy. On the computer, you have to log into your credit monitoring account, then just click a link to lock and unlock. The picture to the right is what it looks like on a desktop. No more phone calls and waiting to get the lock on or off. You control when you want others to have access to your credit report.

Credit Lock is available on your computer, tablet, and smartphone. If you have the TransUnion app on your phone, you can log in, enter you pin, and simply swipe to lock and unlock your credit report. It’s that easy. On the computer, you have to log into your credit monitoring account, then just click a link to lock and unlock. The picture to the right is what it looks like on a desktop. No more phone calls and waiting to get the lock on or off. You control when you want others to have access to your credit report.

One caveat to the use of Credit Lock is the times your allowed to activate your service. You can use this service on Monday through Saturday, from 2 a.m. to 11 p.m. Central time. You can use it on Sunday from 5 a.m. to 11 p.m. Central time. So, it’s not quite 24/7 access. While this may sound a little weird, but I don’t think you would even need access to your report in that short span each night. I could be wrong.

What Other Features Are There?

As I stated, Credit Lock is a new feature provided in TransUnions’s credit monitoring service. On top of being able to lock/unlock your credit report, you can also monitor your credit and get an analysis of how you’re doing. It’s important to know what’s happening with your credit, especially with all of the rampant identity theft going on around this country and the world. Here are the other features you get when you sign up for TransUnion’s Credit Monitoring service on top of their new Credit Lock feature. These are essential to keeping your credit profile safe.

As I stated, Credit Lock is a new feature provided in TransUnions’s credit monitoring service. On top of being able to lock/unlock your credit report, you can also monitor your credit and get an analysis of how you’re doing. It’s important to know what’s happening with your credit, especially with all of the rampant identity theft going on around this country and the world. Here are the other features you get when you sign up for TransUnion’s Credit Monitoring service on top of their new Credit Lock feature. These are essential to keeping your credit profile safe.

[list]

[list_item icon=”entypo-check”]Credit Score – You get access to your TransUnion VantageScore every time you log in. This provides a glimpse into what other institutions will see when they use TransUnion to check your credit. The higher the score, the better![/list_item]

[list_item icon=”entypo-check”]Instant Alerts – I like this feature. TransUnion will immediately contact you via email when a credit inquiry has been made in your name. If you’re not the one who authorized the inquiry, then you can report it quickly. [/list_item]

[list_item icon=”entypo-check”]Internet Watch – This is slightly scary, but a necessary evil these days. Internet Watch will track your personal data to see if it’s being bought or sold online. The system alerts you if your information might have been jeopardized. [/list_item]

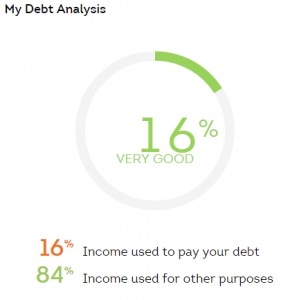

[list_item icon=”entypo-check”]Debt-to-Income Analysis – A number I’m all too familiar with, yet many people have no idea what it is. Your debt-to-income (DTI) ratio is important when borrowing money. This is a simple equation which just shows you how much of your income goes toward paying debts. It can be an eye opener if you haven’t run the numbers before. This works off your self-reported income numbers.[/list_item]

[list_item icon=”entypo-check”]Credit Restoration – You get direct access to a credit restoration specialist who can act as a Power of Attorney for you in order to restore your credit.[/list_item]

[/list]

If you’ve been wanting to get a better hold on your credit, then think about trying out TransUnion’s Credit Monitoring service. The Credit Lock is now included, which gives you the ultimate and quick control to deal with borrowing money on your terms. Remember, this is a service that helps your keep up with your credit, not so much one that helps you improve it. If you have bad credit and want to learn how to increase your credit score, then check out this article we posted just a few days ago. The information will help you get a hold of your finances and raise your credit score over time.

*All Images were screenshots of TransUnion’s credit monitoring service.

I agree that your credit report says a lot about you. My credit report in the past use to say that I was a hot mess. I don’t believe people really understand how important your credit report is when you are trying to upgrade your life. Ever since I started paying off debt and making better decisions, my credit report now says good things about me and we now have a wonderful relations. If you don’t babysit your report, your making a huge mistake.

There are many people that do not understand how their credit will impact them later in life. Keeping a solid score is very important if you ever want to save money on interest and possibly buy a home. Or even get accepted into an apartment.