Which Is Better? A Raise Or Bonus at Work?

My buddy Jim called me the other day and told me about an interesting decision his boss asked him to make. Jim works for a small company and had just been given his annual performance review with his manager. Obviously, Jim was anxious to learn what kind of salary increase he’d be getting, but his boss through a curveball at him and actually offered him a choice.

Here are Jim’s options as he explained them to me over the phone. Option one is to receive a salary increase of three percent with no bonus eligibility. Option two is to receive a five percent bonus for the year but no salary increase.

Which do you think is the better option?

At first glance many people would grab the bonus. The reason that five percent is better than three percent so that must be the way to go.

But let’s think about it for a minute shall we?

I don’t know what your salary is so let’s just choose a random number and say you earn $50,000 a year.

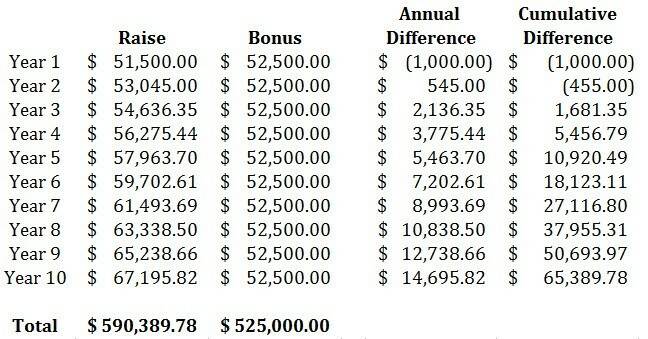

If you choose the three percent raise your salary will be bumped to $51,500 next year. If you decide to go with the bonus, your salary will remain $50,000 but the bonus will push your actual income up to $52,500.

That’s an extra thousand dollars in your pocket so you might be tempted to just go with the bonus. But if you dig a little deeper that extra grand could be costing you a lot more in the long run.

By passing up on the raise you keep your salary set in stone and miss out on the magic of compound interest. And it doesn’t take long before that smaller salary increase compounds into far more than you’d earn with a bigger bonus.

Let’s stretch our earlier example out a bit and say you are given the same decision for ten years in a row.

We already know that you’ll earn more in the first year if you choose the bonus, but what about year two and beyond? The simple chart below will help illustrate the point.

The bonus would yield you the same $52,500 since your base salary is the same, and your two-year earnings would total $105,000. But if you choose the salary increase you’d earn $53,045 (an additional increase of $1,545 on top of the previous year’s salary of $51,500) and your two-year earnings would total $104,545. The thousand dollar gap has shrunk to just $455.

By year three, the pendulum has swung in the other direction and your total earnings is greater when you choose the raise over the bonus. And the difference only grows more and more as the years go by. After ten years the cumulative difference has grown to an amazing $65,389.78! That’s how much you’d be leaving on the table of you chose the bonus over the raise.

A Final Note

Bonuses are never guaranteed and when the economy takes a nosedive or a company has an off-year they can easily pull the plug on bonuses. But salary increases are much harder to take away and that guaranteed money is another reason to consider the raise over the bonus.

Without looking through the math, what would you choose? Salary increase or bonus?

If you pass up the salary increase, you lose the compounding effect of your salary. While a bonus is nice, if you don’t have one set up within your employment contract to regularly receive for performance, they can disappear quickly and you will be stuck back down at your lower salary.

I would definitely choose a salary raise. I know some people who pick a bonus over a salary raise.

The salary raise will be even more meaningful if you have a 401K with a match at your work, since that’s additional money your employer will be putting in your retirement over time. The only reason I would consider the bonus over the raise is if I thought I would be changing employers in the next year.

Hi Mike – Dissenting opinion here, even though we’re both from NJ! While it might be tempting to take the salary increase, there’s much to be said for “cash on the barrel”. Salary increases aren’t guaranteed, and the higher salary could result in a more likely layoff in a bad economy.

It’s easy to choose the salary increase in a relatively stable economy where the future seems more certain, but that could change in a recession or if the company has a couple of bad quarters. The higher salary could make you a target. We also need to consider that most jobs pay within a pay range – once you get to the top of that range the pay increases will stop, which means that compounding isn’t so likely.

Also, the benefit of the bonus increases if you invest the money. Then you’re getting compounding on your bonus. I’m not saying I’d always take the bonus, but it would be a harder choice than it seems at first.

Also have to keep in mind that bonuses are considered “supplemental income” and get taxed 25% typically. Then if you have 401k automatically deducted from your paycheck, that is often taken off as well. Say you have 10% going into 401k. Out of a $2,500 bonus, you’d take home $1,875.

I’d go for salary increase as this is accumulated on a daily basis compared with bonus, which is not guaranteed and depends on performance or criteria.

If you think of it from an ROI perspective, it is even more of a clear choice.

Even if you passed up a 6% bonus for a 3% raise, you’re making a 50% return on investment. That’s unheard of.

Compound that with the tax advantage of a raise over a bonus, and you can quickly see where the smart choice is.