Paying Off Debt and Saving

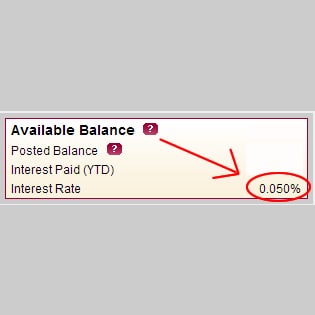

You Can Save While Paying Down Debt! I know this is a cliche topic. Most will tell you that you should stop saving when you are paying down debt. Why do they say this? It is simple. The math isn’t in your favor when you take time to save. Debt usually comes with high interest…