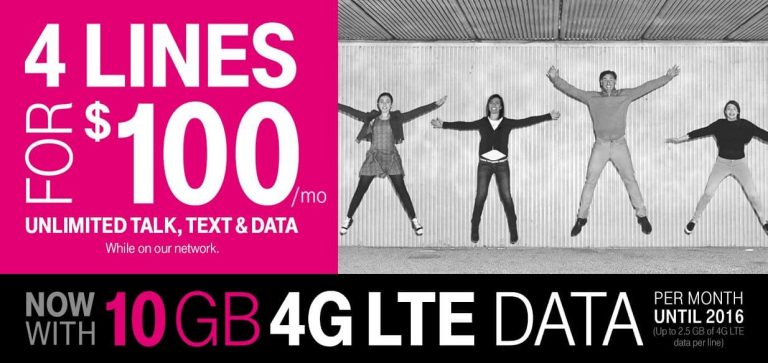

T-Mobile Offering 4 Lines for $100 Per Month ($25 Per Line!)

T-Mobile is at it again with a great new promotion for those looking to save on their monthly cell phone bill. T-Mobile now is offering their Family Plan up to 4 lines for only $100 a month. Yes, for you math geniuses, that is only $25/per month per line. Now, you can really only get a cheaper plan on Republic Wireless, but this is going to be the next best thing. I just wanted to share this with you as I know a lot of my readers like to save money on their cell phone bills. I do to and that is why I review so many services. Anyway, here is the gist of the offer.