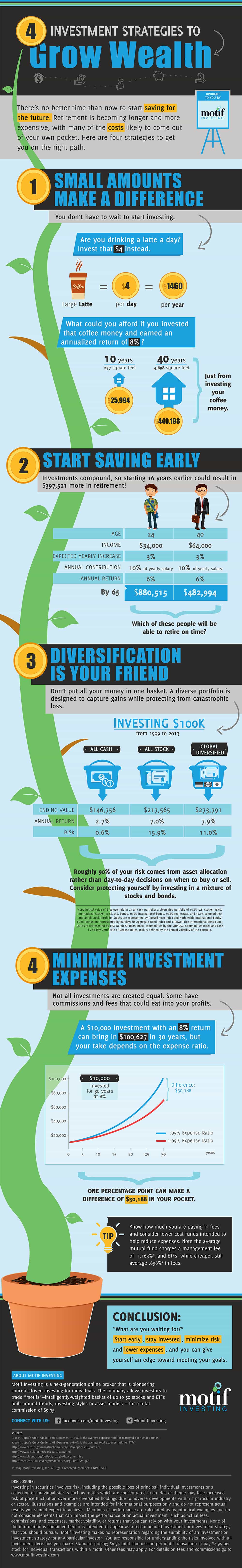

Use these 4 Investment Strategies to Grow Your Wealth

My friends over at Motif Investing created this great infographic on how to grow your wealth with simple investment strategies. As regular readers know, I’m a fan of infographics. I feel they are easy to follow and some of them provide awesome visuals on a topic which might be boring otherwise. If I get a chance to put up an infographic, I will do it! Since I’m a Motif Investing account holder, I found this on their blog. I wanted to share it with you as well.

I know when I just got out of debt, I wanted to focus on investing. I wanted to prepare for my future financially and saving money in my Capital One 360 account wasn’t doing it. It would only bring me a few cents here and there. I would never retire on those earnings. Investing was the logical step.

Unfortunately, I didn’t have the knowledge about investing. It was a scary subject for me. The thought of losing my hard earned money if the market crashed scared the hell out of me. After some time researching, I felt better with starting to invest. After a few years, I have a Roth IRA, my 401(k), and two taxable investment accounts (Motif Investing and Scottrade).

Here are the four investment strategies that will get you going. I didn’t follow one of them, but that was due to my negligence and focus on my debt repayment.

Start Small

Many people don’t think they have enough money to invest. Well, if you find the right account, you can start with as little as $25. I started my Roth IRA through Betterment and all I needed as $25 to get started. You can also check out Wealthfront (there is no fee for up to $15,000 when you sign up using this link).

You do have to pay a monthly fee if you don’t deposit $100 a month, but that should be an amount you should put in anyway. Motif requires $250 to start trading. Others, like Vanguard, have funds which require at least $1,000 to start. No matter what you do, just start.

This tip really focuses on continuing to fund you investments with small amounts. If you skip your coffee for the week, then you can put about $25 or more into your investments. These little bits help out over time. Never think an amount is too small to put away in your investment account. Trust me, not everyone has a couple thousand to put away into investments.

Start Early

I wish I would have followed this advice and I’m kicking myself to this day. While I did start investing with a 401(k) when I got my current job a year after college, I never really funded it to it’s potential. Hell, I didn’t even fund enough to get a full company match. That was just stupid on my part. I do more than enough now to get the full match, but I can’t make up for those lost compounding interest years. That’s where the real power of investing comes from.

When you have the ability to open an investment account, just do it! Don’t wait until a couple of years down the road. The worst part for me is I could have loaded up my investments during the recession and I would have made a killing up to this point. Buy low and sell high my friends!

Diversify

You have probably heard about diversification. It’s a concept simple to understand and one easy enough to implement. It means to no put all of your eggs in one basket. With regards to investments, never hold just one stock as your investment strategy. You should put your money into different stocks across different industries.

You can diversify further by adding in mutual funds and index funds. These are good ways to instantly diversify. Taking it a step further, you can also hold gold, invest in real estate, and carry some cash. When your money is spread out in different areas, it’s less likely to be fully affected when the market dips.

Minimize Fees

Another mistake on my part, especially regarding my 401(k). I do have some leeway in my account, so I went in there one day and changed some allocations around. I found a fund I wanted to be a part of, as I didn’t have much international exposure. I saw the information on the fund, but glanced over the fees part. The expense ratio on that fund was quite high. I don’t remember it off hand, but it was easily triple my other funds. While it had good growth, those fees were eating away at my potential growth.

Always be cognizant about the fees you are paying. If you have someone managing your money, make sure you know what they are charging you. You can just ask and they have to provide it. The more fees, the less you can expect to earn over the course of your investments. According to the graphic, just one percentage point can change your outcome by over $30,000! That’s no chump change my friends.

Great article.. It’s always nice when you can not only be informed, but also entertained!

Starting to invest early is absolutely key! It’s just so hard to catch up if you don’t begin when you’re in your 20’s. I think every high school student should get a copy of this infographic 🙂

Excellent article. Save, invest and grow net worth slowly. It seems easy but many people do not execute properly. Thanks for sharing!